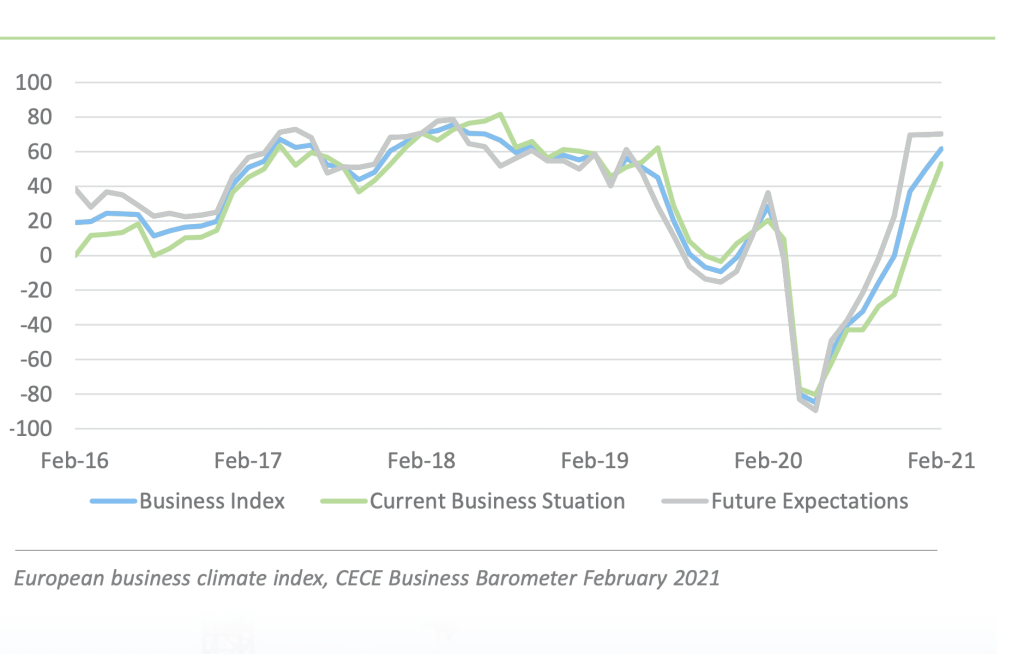

Madrid, June 15, 2021.- CECE is the Committee for European Construction Equipment, and every year it publishes its report on the construction sector in the old continent. Your spokesperson is very clear. Riccardo Viaggi, CECE Secretary General: “The business sentiment that we gauge monthly through the CECE Business Barometer is at very optimistic levels in early 2021. This leads us to believe that the rebound of Q4 2020 is here to stay and could even gain further momentum if the implementation of the national recovery plans will be smooth”. Below I highlight the figures and considerations from CECE on the construction industry in Europe, both in 20221 and in 2022:

- Sales of concrete machinery on the European market went down by 20% in 2020 and performed within expectations against the backdrop of the pandemic. The first half of the year was very weak with declines of 17% and 32% in the first and second quarters, respectively. After a modest decline of 8% in Q3, it is notable that this sector, unlike others, did not see an upturn in the last quarter (-22%). This was an unexpected outturn, but it should be borne in mind that volumes in this sec- tor are low compared with others, and this can sometimes result in more volatile percentage changes quarter-on-quarter. The sector saw a range of different sales performances across the equipment types in 2020. Sales of stationary concrete pumps declined modestly by 3%, while truck-mounted pumps saw a 13% fall in sales. Truck mixer pumps saw sales decline by 19%, while truck mixers recorded a 25% reduction in sales. Batching plants were less affect- ed and sales declined by only 5%, while mixer systems were almost unchanged in 2020 with only a 2% fall in sales. Finally, concrete vibration equipment – the only segment with significant sales volumes – saw a moderate decline of 5%. The major markets saw some notable differences in sales. While Germany saw a moderate decline in concrete machinery sales of 8%, the French market fell by more than 30%. Italy also saw a substantial decline, as sales went down by more than 20%, and Southern European markets recorded a 28% fall. Sales in the UK declined by more than 25%, Benelux markets saw a substantial 37% decline, and Nordic markets saw business fall 16% below 2019 levels. On a more positive note, CEE markets saw a sales increase of 4%, and concrete equipment sales in Russia went up by more than 30%.

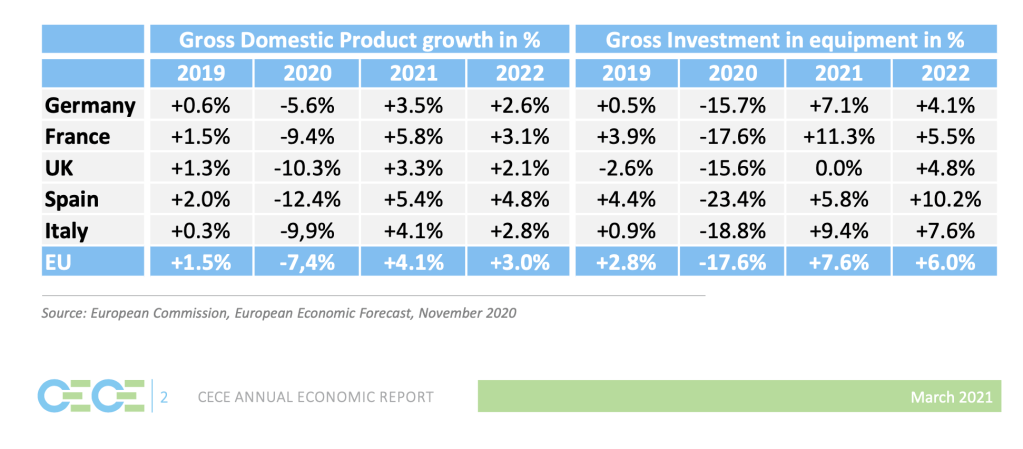

- In November 2020 construction output increased by 1.2% in the EU-27 compared with October 2020. In the euro area the increase amounted to 1.4%. After an unprecedented decline in March and April due to the pandemic, construction output showed a dynamic increase of 22% in May. In the months following this output recovered further, but relatively moderately. As a result, by November 2020 output had reached 97.5% of the pre-crisis level in February 2020. It is expected that for the full year, construction output in Europe will show an 8% decline in 2020. For 2021, the forecast is for growth of more than 4%, to be followed by 3.4% in 2022, and 2.4% in 2023, retaining a positive outlook.

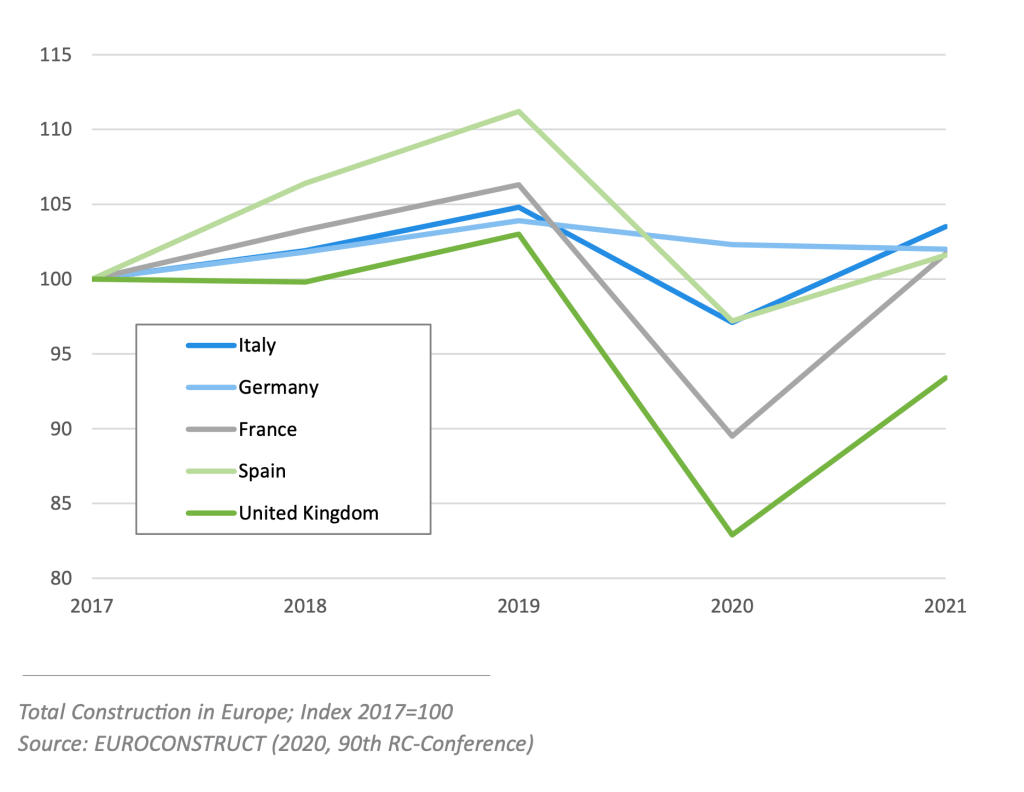

- The construction sector has felt a significant impact from the pandemic but the consequences have been different across the countries in Europe. The construction sector had already been weak in Finland and fairly stagnant in Portugal and Norway. However, in contrast, the United Kingdom suffered a significant fall in activity during the year resulting in a 12.5% decline in output in 2020. This was the first annual fall in output since 2012 when it fell by 7.2%, and was the largest decline since 2009, when it fell by a record 13.2%. However, the pandemic continues to hold back demand for construction work and construction companies have become more pessimistic about business prospects for the coming year due to its impact on businesses, households and local authorities.

- The impact of the pandemic on the construction sector is expected to persist during 2021. Finally, the impact of Covid’19 can clearly be seen on the construction market in Italy. In April 2020, output fell by 51.5% on a month-on-month basis, following a sig- nificant fall of 36.4% reported in March. In the three months to April 2020, the index for construction output showed a decline of 33.2% compared with the previous three months, and year-on-year the index plummeted by 66.7%. Since the summer, construction activity has partially recovered, but has not been strong enough to compensate for the losses incurred earlier in the year. Over the first eleven months of 2020, the index for construction output showed a fall of 8.6%.

- Concerns over the long-term impact that the pandemic will have on the construction sector, as well as the lack of new projects in the public and private sectors resulted in manufactures reporting a more pessimistic outlook for the euro area for a fifth consecutive month. Looking at the major countries, France and Germany continued to report further de- clines in construction activity, with France signaling the largest drop since May. In contrast, Italian companies reported marginal growth in activity for the first time since September. Looking ahead, a strong recovery is expected for the Spanish construction industry in 2021 with growth of 7.4% anticipated. Growth prospects in France are even more positive, with output expected to increase by around 10% this year. In the UK, and in many other European countries, a strong housing sector is expected to be significant in helping to weather the COVID-19 storm. However, new retail, hotel and office construction will continue to see reduced activity for many months.

- While the major European markets experienced a downturn in rental activity, the latest estimates show that business was better than expected in Northern Europe, with many markets recording small falls (Denmark -2.3%, Sweden -2.2%, Netherlands -2.3% and Germany -3.1%). In Italy (-11.3%) and Spain (-14.3%), the outcomes published in February 2021 were in line with the October estimates, whereas in France, activity was lower than forecast. A fall of 15% was seen in 2020, but partial recovery is expected in 2021 with 9.5% growth forecast. In terms of future trends, the ERA expects relative inertia in the construction sector, and anticipates that government policies will provide positive support for a better outlook for the equipment rental industry. The expected reductions in private sector investments will be offset by increases in infrastructure and renovation via public support measures. The ERA expects economic uncertainty and limited CAPEX investments by contractors and end users will encourage increased use of rental equipment. The report also features an update on the North-American situation, with collaboration from the ARA. The figures provided in the report reflect a slow recovery from the recession induced by the pandemic in the U.S. The depth and duration of the impact within the construction sector suggests that equipment rental revenues.

- Sales on the European construction equipment market went down by 6.4% in 2020. This reflected a combination of a cyclical downturn that was anticipated after years of growth, and a slowdown in business activity due to the Covid pandemic. While it is evident that the construction industry and equipment trade were less affected by the pandemic than many other industries (especially the service sector), it was still a pleasant surprise to see only a modest market decline in 2020 amid the Covid crisis.

- However, behind the high level figures, there were some significant differences experienced between different equipment segments. In the light and compact equipment segment, sales were almost unaffected by the crisis, and fell by less than 3% last year. This was significant, because it is a high volume segment, and helped to limit the overall fall in sales for construction equipment. However, in contrast, heavy construction machinery suffered a 19% fall in sales, in what emerged as a difficult and challenging year. In summary, less expensive ma- chines were sold at almost normal levels during the pandemic, while investment in more capital-intensive equipment suffered from the economic uncertainty. Un- like earlier years, the different equipment segments experienced similar market experiences last year, despite the impact of stronger sales of light equipment. This was the case for earthmoving equipment, road equipment, concrete equipment and the tower cranes business. From a geographical perspective, market sales in most countries reflected the impact of the pandemic and the lockdowns, but there were a few exceptions. Most notably, the Italian market reached the same level of sales as 2019, and the Turkish market recovered from the crash experienced in 2019.

- Compact equipment (-8%) performed considerably better than heavy equipment (-18%) in 2020. On the compact side, backhoe loaders saw the smallest decline of 6%. The two highest volume products, mini excavators and compact wheel loaders, both saw 8% declines in sales. In the heavy segment, both crawler and wheeled excavators recorded 20% de- clines in sales, while wheeled loaders saw a more modest fall of 16%. Unsurprisingly, the largest machines suffered the biggest falls in sales, with ADTs and rigid dump trucks both declining by more than 25%. All the major markets saw sales decline in 2020. The biggest market Germany, which accounts for 23% of European sales, went down by 8%. Following falls in France of 15% and 22% in the UK, these markets are now at a similar level, both accounting for 13% of total sales in Europe. Southern European markets re- corded a 7% sales decline, but there were diverging trends, as the Italian market was stable, while Spain and Portugal saw sales decline. Nordic markets went down by 15%, but this was from a peak level reached in 2019. Benelux was also affected by the crisis and recorded a 16% fall in sales. CEE markets saw a moderate de- cline in sales of 11%, but the performance varied across the different countries. The Russian earthmoving equipment market was virtually unchanged in 2020. Finally, the Turkish market saw sales al- most double, coming from extremely low levels after a disastrous year in 2019.

- Tower cranes sales in Europe went down by 14% in 2020, exhibiting a familiar pattern. After a 16% decline in the first quarter and a 32% downturn in the second quarter, Q3 only saw a minimal decline of 4% and the last quarter saw a return to moderate growth of 5%. In previous years, percentage changes in the tower crane sector have been more volatile than the construction equipment sector, due to the low volumes of tower cranes which can more easily result in large percentage changes. However, it is no- table that this was not the case in 2020. Looking at countries according to their market size in Europe, the largest market France saw only a modest decline in sales of 6% in 2020. However, tower crane sales in Germany fell by 24%. The market in Austria and Switzerland is also significant for tower cranes, and recorded a 5% increase in sales. The UK market declined by 23%, and the Russian market saw a strong recovery with growth in sales of over 50%. Southern European markets went up by 10% due to strong sales in Italy. The biggest downturn in sales in 2020 were seen in the Benelux (-42%), CEE markets (-32%) and Nordic countries (-39%). Finally, unlike other equipment sub-sectors, the Turkish tower cranes market remained at historically low levels.

You must be logged in to post a comment.